We explore the great French vineyards to find perfect Brand, Identity, Values and Purpose. What can business learn?

While sitting on a stalled, swaying chairlift above the Chamonix valley several years ago, I struck up a conversation with a nearby Russian skier.

It wasn’t long before we were discussing the breakup of the Soviet Union . I asked, ‘Was it hard to change from communism to capitalism after Gorbachev?’ . ‘No', my companion replied, 'the hardest challenge was to know ‘who we were’ and ‘what was our identity’.

The war in Ukraine clearly illustrates the question still isn’t resolved, and emphasises the importance of identity in our lives and in the companies where we work. Its no coincidence that a company’s identity and brand is one it's greatest assets.

For those at the cutting edge of building new companies - private equity and in mergers and acquisitions, creating identity should be paramount

We travel to Burgundy (Bourgognes), France. The region has linked the long ridge of world renowned vineyards into a unique single brand and IDENTITY.

In the far south (title picture), my wife highlights the red and white sign for Chateauneuf du Pape.

And Cote Chalonais through to Cote de Beaune and Cote de Nuits are all identified with the same signage.

The power of IDENTITY in Burgundy

Burgundy vineyards are represented by uniform and attractive signs over this wide area, associating an identity of quality and trust. A tribute to growers and regional government.

We can also see identity conveyed through architecture. The elegant shuttered buildings of France are duplicated throughout former Indo-China as shown below.

You're excused for walking along the beautiful Mekong riverfront in Phnom Penh, Cambodia and believing you may be in France!

Identity expressed in architecture

This is reproduced in Vietnam and Cambodia. Saigon's railway station (top) and Cambodia's Foreign Correspondents Club FCC are classic examples of how 'Frenchness' became part of former Indochina.

Importance for Private Equity and Mergers and Acquisitions

At Labovitch we fundamentally believe that companies should be merged organisationally, operationally and culturally. A finance and legal framework aren’t sufficient.

Please see https://labovitch.co.uk/mergers-acquisitions

For Private Equity and Mergers and Acquisitions, businesses often target EBITDA (earnings before interest, taxes, depreciation and amortization) as the measurement for portfolio success . Despite this why do 80% of mergers fail to achieve expectations?

Undoubtedly ignoring 'human factors' contributes to lackluster performance. These factors importantly include organisation, culture, values and identity.

Motivation and success are generated through a planned and implemented change programme contained in the well proven Labovitch method - 8 Pillars of change https://labovitch.co.uk/the-8-pillars-of-change/

The 8 Pillars include programme management, but importantly managing resistance, toolkits and creating new identity.

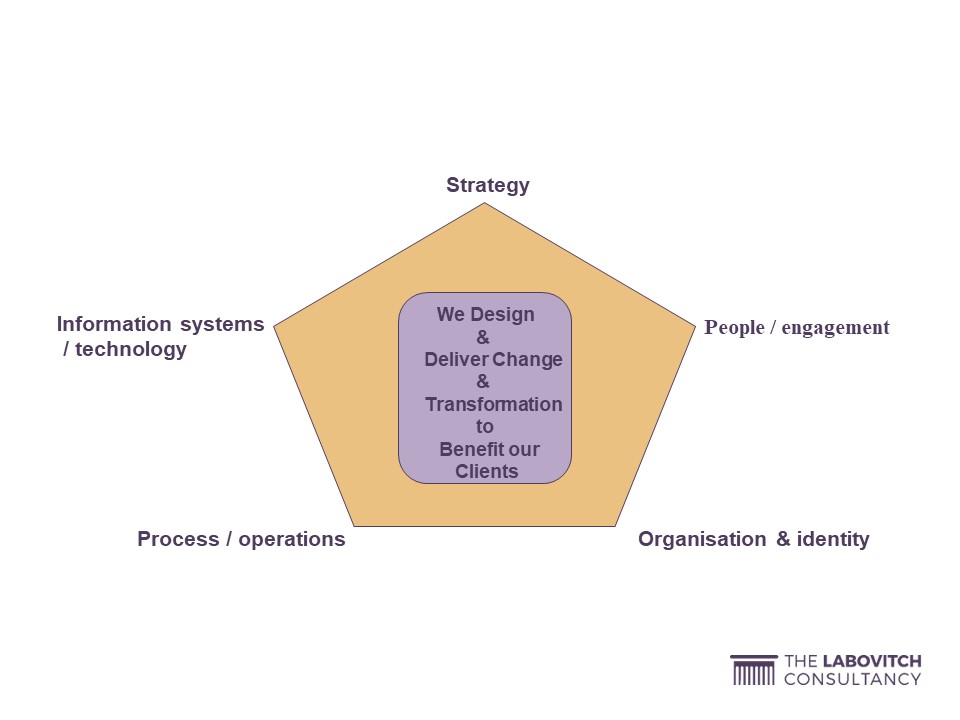

Strategically organised change will comprise strategy, people, organisation, operations and information systems.

Free Briefing Checklist

To anticipate and plan for change, Labovitch provides a Free Briefing Checklist where clients can assess their drivers for change including Business, Operations, Information Systems, People and Main Issues. https://labovitch.co.uk/free-briefing-checklist/

Tomorrow and tomorrow and tomorrow

In a constantly changing world, we’ve learned enough from the past to know that balanced change will deliver business benefits of profits, productivity, efficiency and an engaged and motivated workforce.

As people we are motivated by strong cultures and identity. Businesses and especially in Private Equity for takeovers and mergers, ignore this at their peril.

About the Author

Using all these insights we help deliver successful change and M&As for SMEs and larger organisations - public and private sector, both listed / unlisted and for private equity.

Leon Labovitch is CEO of The Labovitch Consultancy www.labovitch.co.uk

Strength for Change, Success for Transformation.

At The Labovitch Consultancy we are pleased to discuss any potential project with you even at the earliest stage. We will do so freely without cost or obligation but of course in the strictest confidence. Please Contact Us for more information.